Lookfantastic owner THG's share price falls further

- Published

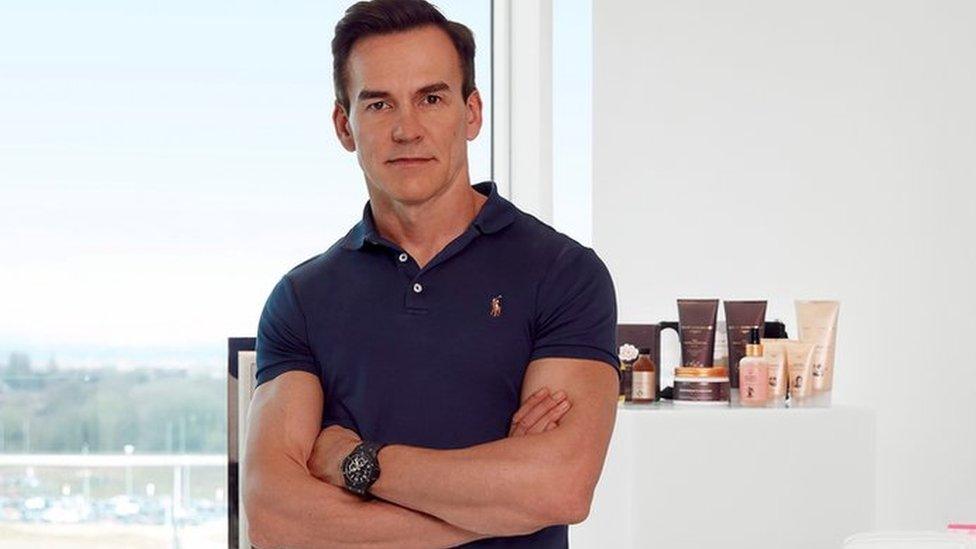

Billionaire Matthew Moulding's THG runs more than 100 websites

Attempts by Matthew Moulding's THG to appease concerns over trading and corporate governance have sparked another dive in the share price.

The online beauty retailer and software firm, which owns Lookfantastic, posted a positive trading update and said it was seeking an independent chairman.

But a shares sell-off that started this month continued on Tuesday with the price down another 20% at 239p.

THG, formerly The Hut Group, floated on the stock market at 500p a share.

The price rose as high as 600p on the first day of trading in September last year.

On Tuesday, THG confirmed it had hired recruitment firm Russell Reynolds to find an independent non-executive chairman as part of plans to move the firm to a premium listing on the London Stock Exchange.

The Manchester-based company, whose brands include make-up firm Illamasqua, supplements business Myprotein and the recently acquired Cult Beauty, also appointed Andreas Hansson to the board.

He is managing director at Japan's SoftBank, which owns about 10% of THG.

Last week, it was announced that Mr Moulding, THG's founder, chief executive and chairman, would relinquish his "golden share" in the company which stopped it from being included on London's FTSE indices and enabled him to block a takeover of the business.

That followed a meeting with shareholders the week before, when concern was expressed about THG's structure and the prospects for Ingenuity, a technology platform it hopes to license to other online retailers.

After that meeting, the company's shares tumbled by 35%, wiping at one point 拢2bn off the value of the business.

On Tuesday, alongside news of executive moves, THG announced that group revenues had increased by 38% to 拢507.8m in the three months to September on the same quarter last year. It also raised revenue growth expectations for Ingenuity.

Mr Moulding said: "We have delivered a strong trading performance in third quarter and enter our peak trading period with confidence.

"The appointment of two independent non-executive directors and four special advisers since IPO has been hugely beneficial to the board, and we have real optimism for 2022 with the step up to a premium listing on the main market of the London Stock Exchange, following the appointment of an independent chair," he said.

JP Morgan Cazenove analysts said in a research note that "all in all, some steps [are] clearly in the right direction", but warned that Ingenuity needs to find more clients "to restore confidence".

Mr Moulding and his wife Jodie were ranked 78th on this year's Sunday Times Rich List with a 拢2.1bn fortune.

- Published18 October 2021