Paul Volcker: Former US Federal Reserve chief dies aged 92

- Published

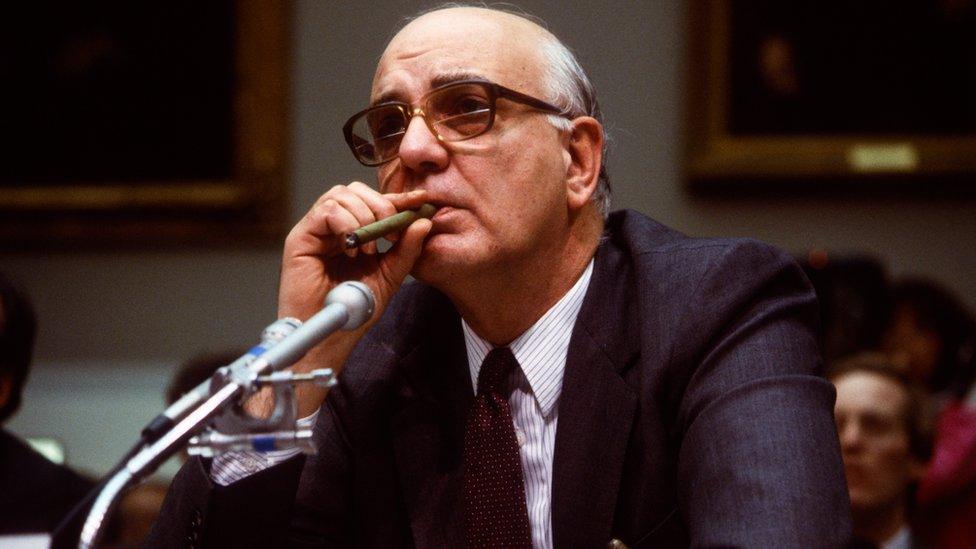

Paul Volcker appears before Congress in 1986

Paul Volcker, the former head of the US central bank who was known for fighting inflation, has died at the age of 92.

Appointed chair of the Federal Reserve in 1979, Mr Volcker dramatically raised interest rates to combat inflation.

The move drove the US into recession, but was credited with creating the conditions for long-term growth. It also helped to burnish the bank's reputation for independence.

Mr Volcker's tenure at the top of the Fed ended in 1987.

More recently he had advised former US President Barack Obama on bank regulation following the financial crisis, overseen the return of money to Holocaust victims, and investigated a United Nations oil-for-food programme.

"His life exemplified the highest ideals - integrity, courage, and a commitment to do what was best for all Americans," current Federal Reserve Chair Jerome Powell said in .

A legendary figure in American finance, Mr Volcker was known for his penchant for cheap cigars as well as his towering height, given that he was six feet eight inches tall.

He also had a reputation for delivering blunt truths. In order to reduce inflation, he warned the US Congress: "The standard of living of the average American has to decline. I don't think you can escape that."

In a 2018 interview with the New York Times, he said he saw a "hell of a mess in every direction" due to the loss of respect for institutions like the Supreme Court, presidency and Federal Reserve.

"I don't know, how can you run a democracy when nobody believes in the leadership of the country?" he said.

Inflationary cycle

Born in 1927 in New Jersey, Mr Volcker was educated at Princeton, Harvard and the London School of Economics.

He served as an undersecretary at the Treasury Department during the Nixon administration and then president of the New York branch of the Fed, before former President Jimmy Carter appointed him Fed chair.

During his tenure, the Fed raised interest rates to more than 20% in 1981 - an increase Mr Volcker insisted was necessary to bring an end to the rapid inflation then plaguing the US.

The move was credited with ending the inflationary cycle, by changing the public's expectations. As fears of rapid inflation waned, so did rapid spending and demands for pay increases - which had contributed to price increases.

Economic activity also dried up due to the sharp rise in borrowing costs, with Mr Volcker bearing the brunt of the blame.

President Ronald Reagan talking to Paul Volcker in 1981

After that shock, however, Mr Volcker reduced rates again, to less than 3%.

Bank of England Governor Mark Carney said Mr Volcker was an "inspiration".

"The integrity and independence he showed in his battle against inflation helped lead the United States - and with it, the world - through some of the most testing times of the modern era," he said.

Decades later, as advisor to Mr Obama, Mr Volcker crafted the so-called "Volcker Rule" which aimed to reduce risky behaviour at federally-insured banks, banning them from using their own funds to invest in risky assets.

Mr Obama said: "Because of Paul, our financial system is stronger, safer, and more accountable to those who matter most鈥攖he American people."

Mr Volcker had reportedly been suffering from prostate cancer. His survivors include two children and his wife, Anke Dening. His first wife, Barbara, whom he married in 1954, died in 1998.

- Published6 December 2017