Pret a Manger's owner considers a New York flotation

- Published

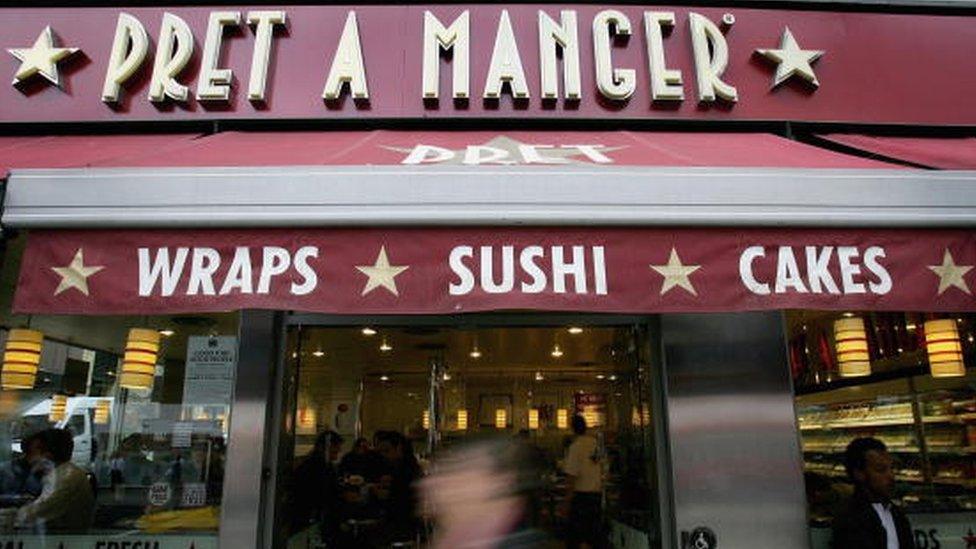

People who love their Pret a Manager sandwiches may soon be able to own a slice of the chain amid reports it may become a public company.

It is understood that Pret's owner, Bridgepoint Advisers, is considering a range of options which may include floating the business in New York.

The US is a growing market for Pret where sales at its 74 outlets surpassed $200m for the first time last year.

Bridgepoint is in the process of naming advisers to examine Pret's next step.

A spokesman for Bridgepoint said: "As a committed shareholder in Pret we are always exploring appropriate opportunities to ensure the future growth of the company.

"If such opportunities materialise, we will update the market."

During 2016, Pret opened 50 new shops including five in the US - where it reported strong growth in breakfast food and coffee sales.

By the end of last year it had 444 stores and announced a 15% rise in revenues to 拢776.2m and earnings before interest, tax, depreciation and amortisation up 11% to 拢93.2m.

It is the third time that Pret a Manger has considered an initial public offering.

Its founders Julian Metcalfe and Sinclair Beecham considered the move in 2001 but instead provoked controversy when they sold a 33% stake in the business to US fast food giant McDonald's for 拢50m.

In 2007, just before the financial crisis, a flotation was on the cards again but Pret was eventually sold for 拢350m to Bridgepoint and Goldman Sachs.

Mr Metcalfe and Mr Beecham reportedly made 拢50m each when they handed over ownership of the business they founded in 1986.

- Published25 March 2017

- Published9 March 2017