Pfizer's $160bn Allergan deal under pressure in the US

- Published

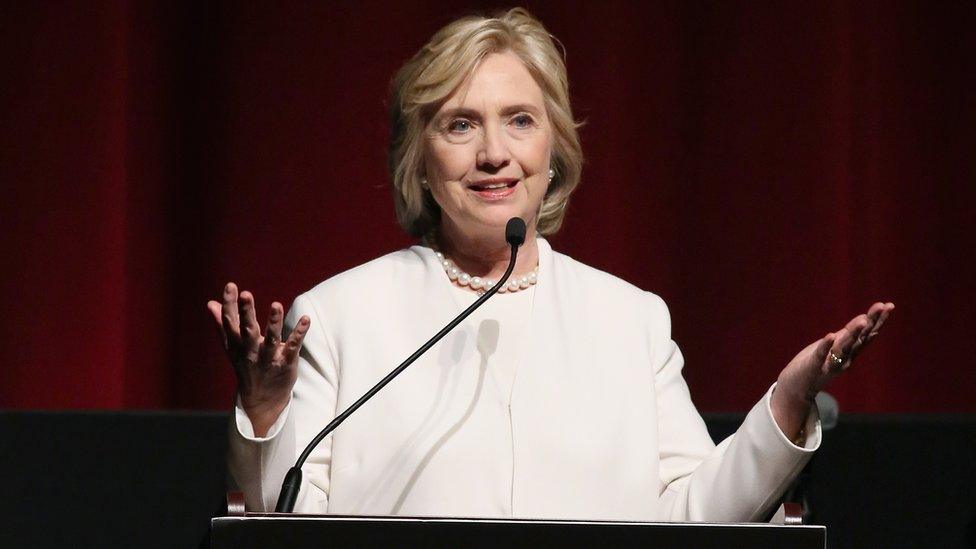

Hillary Clinton has criticised tax inversion deals

Drugs giant Pfizer's $160bn (拢106bn) deal to buy botox-maker Allergan has been criticised by US politicians as an attempt to slash its tax bill.

The deal proposes that the merged company will maintain Allergan's Irish domicile, allowing Pfizer to escape relatively high US corporate tax rates.

Hillary Clinton, the likely Democratic presidential candidate, accused Pfizer of avoiding its "fair share" of taxes.

The deal would "leave US taxpayers holding the bag", she said.

Senator Bernie Sanders, another Democratic hopeful, said the deal would be a disaster for consumers and allow another major US company to hide its profits overseas.

Democratic representative Rosa DeLauro was also critical, saying: "We cannot continue to allow Pfizer and other corporations to pretend that they are American while reaping the benefits this country has to offer, yet claiming to be another nationality when the tax bill comes," she said.

Republican presidential candidate Donald Trump described Pfizer's departure from the US as "", adding: "Our politicians should be ashamed."

If approved, the deal would be the biggest example of so-called inversion, where a US firm merges with a company in a country with a lower tax rate and moves its headquarters there.

In Ireland, the corporate tax rate is 12.5%, compared with the 35% Pfizer currently pays in the US.

Pfizer boss Ian Read said the savings from the deal would give it "the strength to research, discover and deliver more medicines and more therapies to more people around the world".

Last year, Pfizer made a takeover move for rival AstraZeneca, which analysts said was designed to reduce Pfizer's tax bill. The UK drugs firm rejected the bid.

The White House has so far declined to comment on the deal.

But US President Barack Obama has previously called such inversion deals unpatriotic and has tried to crack down on the practice.

Last week, the US Treasury Department unveiled new rules to clamp down on inversions, but tax experts said the change would not be sufficient to prevent the deal completing.

Yet, investors appear uncertain the deal, which is still subject to regulatory approval in the US and Europe, will get the go-ahead.

Shares in Pfizer closed down 2.7% in New York at $31.32, while Allergan fell 3.4% to $301.70.

- Published23 November 2015

- Published29 October 2015

- Published6 August 2015