Federal Reserve to pump $600bn into US economy

- Published

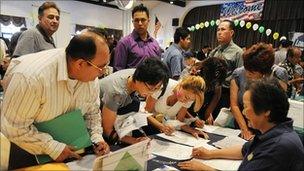

Unemployment remains stubbornly high in the US at 9.6%

The Federal Reserve has announced that it will pump $600bn (拢373bn) into the US economy by the end of June next year to try to boost the fragile recovery.

This stimulus equates to $75bn a month, in a second round of "quantitative easing" (QE).

The US economy grew by an annual rate of 2% between July and September, which is not enough to reduce high unemployment.

Some analysts see QE as the last chance to get the US economy back on track.

The move was widely flagged, with most analysts expecting the Fed to inject $500bn into the economy.

For this reason, stock markets rose only slightly, with the Dow Jones closing up 26 points at 11,215, still enough to take the index to its highest level for two years.

Second step

Interest rates are already close to zero, which means the Fed cannot reduce rates any further in order to boost demand - the more traditional policy used by central banks to stimulate growth.

Instead, it has announced a fresh round of QE, in which it will create money to buy long-dated government bonds.

The programme has been dubbed QE2, after the Fed pumped $1.75tn into the economy during the downturn in its first round of QE.

It is in addition to the Fed's previously announced plan to reinvest $250bn-$300bn of repayments it is due from existing US mortgage debt investments over the coming year.

the "pace of recovery in output and employment remains slow. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth and tight credit".

It added that it would "regularly review the pace of its securities purchases and the overall size of the asset-purchase programme in light of incoming information".

One member of the Fed's Open Market Committee, which decides interest rates and QE, voted against the additional stimulus measures.

Thomas Hoenig argued that further stimulus could, over time, create inflationary pressure and "destabilise the economy".

Bank lending

Opinions are divided about how effective QE2 will be, partly because of questions about how much impact the first, much larger, round of QE had.

Some observers credit the programme with pulling the US out of recession, while others argue that it had little impact on consumer demand and the tight credit conditions that make it hard for individuals and businesses to access bank finance.

As a result, some economists believe the Fed will have to pump far more than $500bn into the economy to make a meaningful difference.

"The bottom line is the plan provides a boost to the economy's growth, but it is not going to solve our problems," said Mark Zandi, chief economist at Moody's Analytics.

"Even with the Fed's action, we're going to feel uncomfortable about the economy in the next six to 12 months."

Slow growth

What most do agree on, however, is that the Fed had to do something.

The US economy grew at an annualised rate of 2% between July and September.

The annualised rate is the rate at which the economy would grow over a year if the three-month growth rate were replicated over all four quarters.

While this was an improvement on the 1.7% annualised growth seen between April and June, it was less than the 3.7% annualised growth recorded in the first three months of the year.

Together, these growth rates are below the historical rates posted by the US economy during recoveries from past recessions.

Also a cause for concern is the fact that growth in business inventories made up more than two-thirds of the annualised 2% third-quarter growth - in other words, businesses simply re-stocking following the downturn.

Job losses

Such modest rates of growth are having little impact on the high level of unemployment in the US, which currently stands at 9.6%.

Official figures show that the economy lost a 95,000 jobs in September, as public-sector cuts outpaced hiring by the private sector.

This was almost double the figure for August, when 54,000 jobs were lost.

It is this high level of unemployment that is acting as a key drag on economic growth.