Rupert Grint loses 拢1m tax rebate appeal

- Published

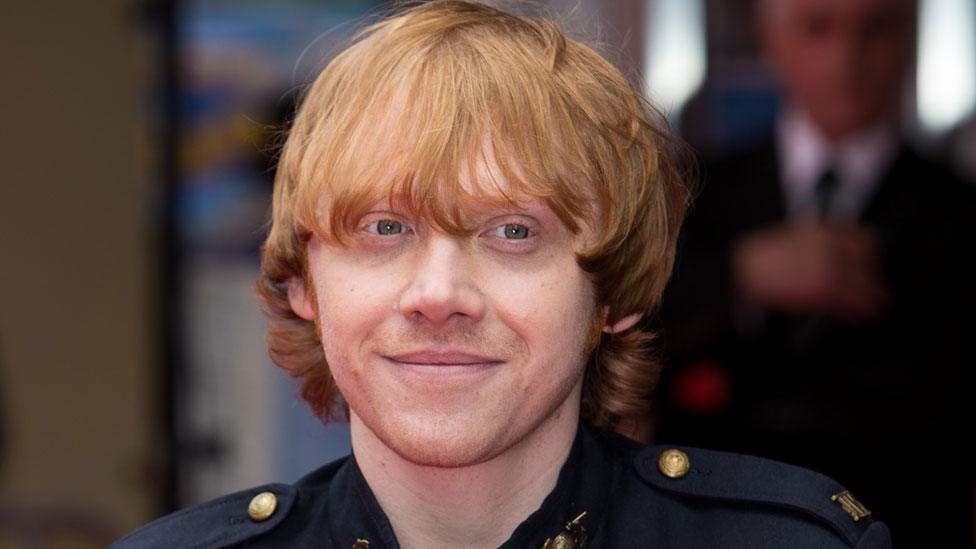

Grint, now 27, played Ron Weasley in the Harry Potter film cycle

Actor Rupert Grint has failed in an attempt to shield some of his Harry Potter income from a higher tax rate.

If successful, the bid could have saved the 27-year-old about 拢1m.

A tax tribunal judge rejected Grint's appeal against an HM Revenue and Customs (HMRC) block on him using a change in accounting dates to avoid the 50% tax rate introduced in 2010-11.

His accountants had tried to move eight months of income into the 2009-2010 tax year, when the top rate of tax was 40%.

The tax authorities agreed that Grint had the right to change his accounting date, but denied he had actually done so.

On Tuesday, Judge Barbara Mosedale described how Grint had followed advice from tax advisers Clay & Associates to change his accounting date so that an extra eighth months of income would be taxed in 2009-10, rather than the following year when the top rate of tax rose from 40% to 50%.

The new rate was brought in by the last Labour government in a bid to safeguard public finances in the wake of the banking crisis, but was abolished two years later.

Dismissing Grint's appeal, the judge ruled the actor had failed to meet the conditions on which the law would recognise a valid change in accounting dates.

The judge stressed it was not part of HMRC's case that Grint - who admitted in June his knowledge of his financial affairs was "quite limited" - was involved in tax avoidance as the tax had already been paid.

"HMRC accepted that he had the right to change his accounting date. The dispute solely concerned whether he had done so within the meaning of the legislation," she said.

In her ruling, she said Grint had made it clear "that he placed his faith in his father and accountants to deal with his financial affairs".

The actor, who played Ron Weasley in the eight-film Harry Potter cycle, was said to have generated a turnover of 拢28m and 拢15m in net profits in the 20 months up to 5 April 2010.

Follow us on Twitter , on , or email entertainment.news@bbc.co.uk, external.

- Published24 February 2014

- Published7 September 2011