We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

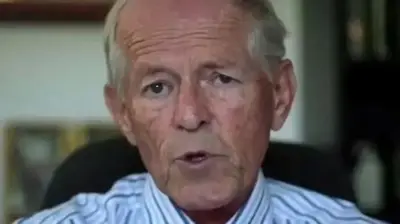

ECB's Draghi says 'more optimistic' on the outlook for the eurozone

The outlook for eurozone growth is "more optimistic", the head of the European Central Bank (ECB), Mario Draghi, has said.

Accordingly, the central bank has raised its economic growth forecasts for this year and next, to 1.8% in 2017 and 1.7% in 2018.

That compares with previous forecasts of 1.7% and 1.6% respectively.

The comments came as borrowing costs were kept on hold in the 19-nation bloc, despite a pick-up in inflation.

It currently stands at 2%, which is slightly above the ECB's target of just below 2%. The bank also raised its annual inflation forecast for this year and next to 1.8% and 1.7%.

"I would say the risks of deflation have largely disappeared," Mr Draghi said at a news conference.

The main interest rate remained at 0% and the central bank's bond-buying programme, aimed at boosting the economy, was also kept unchanged.

'Watershed moment'

The bank is currently committed to continuing its bond-buying programme until at least December, although the âŹ80bn-a-month quantitative easing (QE) scheme will be trimmed to âŹ60bn a month from April.

Asked at the news conference whether interest rates were likely to rise before the end of the QE programme, Mr Draghi replied that policy makers wanted to see "a sustained adjustment in the rate of inflation, and we don't see it yet... we see progress in the recovery [but] it's a gradual process".

the ECB had reiterated: "The governing council continues to expect the key ECB interest rates to remain at present or lower levels for an extended period of time, and well past the horizon of the net asset purchases."

However, Mr Draghi said that a sentence had been removed from his introductory statement to the news conference to signal that "there is no longer that sense of urgency in taking further actions... that was prompted by the risks of deflation".

Neil Wilson, an analyst at ETX Capital, said: "Deflation is no longer the concern for the ECB - prices are not rising fast enough to warrant tapering or higher rates, but the imminent risk of deflation has passed.

"That's something of a watershed moment - the end of the beginning in terms of unconventional monetary policy tools perhaps."

Top Stories

More to explore

Most read

Content is not available