We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

Yellen: Brexit "significant economic repercussions"

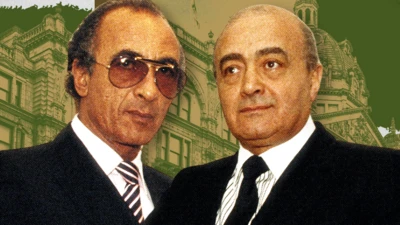

Image source, Getty Images

The head of the US Federal Reserve has said a UK vote to exit the European Union "could have significant economic repercussions".

Janet Yellen told the Senate Banking Committee that a split would lead to uncertainty that could create market instability.

She said the Fed would closely monitor the vote, which could impact global investor confidence.

Supporters of Brexit argue the UK would be more prosperous outside the EU.

Ms Yellen said a UK exit from the EU was unlikely to send the US economy into a recession. But it could result in a "flight to safety" by investors that could push up the value of the dollar and other currencies that are considered havens in time of uncertainty.

She stressed that she was not offering advice to the British public but "simply saying the decision could have economic consequences to the US economy".

US economy faces "uncertainty"

Last month, official figures showed a sharp slowdown in US job creation.

The Labour Department reported that employers added just 38,000 jobs last month, the fewest since September 2010.

The jobless rate fell to 4.7% but much of that was caused by individuals leaving the labour market altogether.

While the job gains across all demographic groups in the US have slowed, Ms Yellen said it was "troubling" that unemployment among African Americans and Hispanics remained below the national average.

Image source, Getty Images

Persistently low inflation and weak productivity growth in the US were noted as concerns for the Fed's board.

Ms Yellen said a lack of investment had contributed to the weak growth.

Risk of low interest rates

Earlier this month the Fed opted not to raise interest rates.

The Fed raised interest rates by 0.25 percentage points for the first time in nine years last December and has left them unchanged since.

Ms Yellen said the central bank was likely to keep rates low in the near term. But she warned that low interest rates left the Fed with fewer options to address an economic downturn.

"I would not at this time say that the threats from low rates to financial stability are elevated. But, of course, it is something that we need to watch because it can have that impact," she said.

One positive sign for the US economy that she pointed to were gains in household spending.

Low oil prices and wage growth have helped, but international uncertainties remain that could derail trade and economic growth.

Ms Yellen cited China's efforts to rebalance its economy towards more domestic spending as one vulnerability to the global economy.

"In the current environment of sluggish growth, low inflation, and already very accommodative monetary policy in many advanced economies, investor perceptions of and appetite for risk can change abruptly," she added.

Top Stories

More to explore

Most read

Content is not available