We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

GlaxoSmithKline scraps float plan for ViiV HIV drugs unit

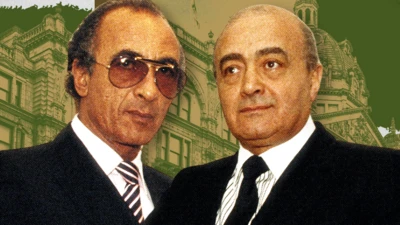

Image source, AFP

UK pharmaceuticals firm GlaxoSmithKline (GSK) has scrapped plans to spin off its stake in ViiV Healthcare, the HIV drugs business.

The company said the decision came following the unit's "updated strong positive outlook".

Sales of HIV treatments rose more than 40% in the first quarter.

The initial public offering (IPO) of ViiV could have been valued at up to ÂŁ18bn, making it one of the biggest IPOs this decade.

In a statement, the company said: "Having reviewed this very positive outlook, GSK has concluded that retaining its full, existing holding in ViiV Healthcare is in the best interests of the Group and GSK will not now be initiating an IPO of a minority stake."

ViiV is a joint venture with US firm Pfizer and Japanese company Shiongi, with GSK owning about 80%.

GSK also reported first quarter sales of ÂŁ5.6bn, in line with analysts' forecasts.

The company also said it would cut the amount of money being returned to shareholders following the deal it struck with Novartis last year.

Under the deal, Novartis bought GSK's cancer drugs business, while GSK bought Novartis' vaccines division. The two firms also combined their consumer health units.

GSK had planned to return ÂŁ4bn to shareholders following the deal, but it now says it will return ÂŁ1bn through a special dividend paid in the fourth quarter.

Top Stories

More to explore

Most read

Content is not available