We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

91»»Ī¨ to cut staff pension benefits

The 91»»Ī¨ has announced plans to overhaul its pension scheme in an attempt to tackle a ¬£2bn deficit.

The proposals include closing the final-salary scheme to new joiners and imposing a cap on the amount pensionable salaries of existing members can grow by to 1% a year.

The moves are the first major changes by a publicly-funded organisation.

The government has ordered a review of public sector pensions, chaired by ex-Labour minister John Hutton.

Meanwhile the Prime Minister David Cameron has already warned that public sector workers should expect less generous pension arrangements as the UK seeks to repair its finances.

Deficit worries

The 91»»Ī¨ said the changes were essential to tackle the ballooning deficit in the pension scheme, which is now estimated at ¬£2bn, compared with ¬£470m just two years ago.

"The 91»»Ī¨ is not alone in this - pension schemes in both the private and public sector are facing similarly difficult decisions," said Zarin Patel, the 91»»Ī¨'s chief financial officer.

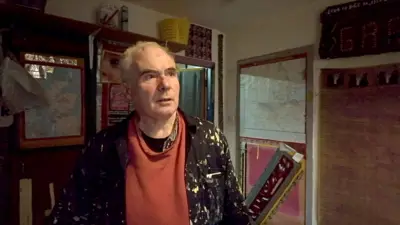

91»»Ī¨ business editor Robert Peston says the plans could be a blueprint for future public-sector pension plans.

"The 91»»Ī¨ is a public-sector organisation, albeit one proud of its independence from government," he says.

"What it is doing may therefore influence how the new coalition sets about reducing the costs and liabilities associated with those supposedly gold-plated final-salary pensions in the rest of the public sector."

Broadcasting union Bectu condemned the proposals, which will be subject to a three-month consultation period.

The union's general secretary, Gerry Morrissey, said they would "permanently break the link between an individual's salary and their final pension".

"In addition, the employment benefits package will not be as attractive to new employees and we believe that the 91»»Ī¨ will struggle to attract staff with the appropriate skills levels, especially as the 91»»Ī¨ will be recruiting a significant number of people for Salford from January 2011."

Staff 'outcry'

Pensions experts agreed that the changes were far-reaching.

"The 91»»Ī¨ appear to have adopted some of the more aggressive proposals to restructure pension scheme benefits for members in their current employment," commented Danny Wilding, partner at Barnett Waddingham, a pensions consultancy.

"[The proposals] will significantly reduce the value of both future pension and the pension already built up for members in 91»»Ī¨ employment, especially for younger members."

Under the proposed changes, from 1 April 2011, an employee's pensionable salary will rise by no more than 1% a year, even if that employee gets a substantial pay rise.

From 1 December, members of the existing final-salary scheme will have the choice of continuing to contribute to it or of paying into a new defined-contribution plan.

However, no change is planned to the current 91»»Ī¨ retirement age of 60.

Zarin Patel said the measures would be "the most extensive changes to the scheme in its history" and would affect 18,000 members of staff.

"We have thought long and hard about the changes we propose," she said.

Our business editor says the changes will inevitably cause a massive outcry among staff, as happens in the growing number of private-sector firms which close their schemes to future contributions or cap their liabilities.

He also points out that not all companies under pressure reduce benefits to this extent.

"BA, which is arguably in much worse financial shape than the 91»»Ī¨, has kept its seriously indebted schemes open for contributions," he says.

Private-sector woes

In June, British Airways reached agreement with its pension trustees on a plan to reduce its £3.7bn pension deficit.

It said the plan would avoid the closure of its two final-salary pension schemes.

BA's merger with Spanish flag-carrier Iberia hinges on its pension recovery plan. If Iberia deems the plan unsatisfactory, it has the right to pull out of the merger.

Earlier this year, a dispute over pensions nearly led to a strike at the AA, after patrol staff objected to the company's plans to reduce a £190m deficit in its scheme.

AA wants to put a ceiling on annual rises in pensionable salaries, to raise employee contributions and also to cap the annual rise in pensions paid to 2.5% a year.

Other companies that have recently announced changes to their final-salary pension schemes include insurer Aviva, construction firm Taylor Wimpey, Trinity Mirror, Pirelli, Fujitsu, Barclays, Morrisons, Vodafone, BMI, Dairy Crest, IBM and Costain.

Downturn 'hits pensions'

The changes at the 91»»Ī¨ come as the number of people saving enough for their retirement has fallen by 6% to 48%, according to a survey by Scottish Widows.

The Edinburgh-based life and pensions provider said the figure was the lowest since 2006.

The economic downturn was blamed by 41% of people in the UK for saving less.

The study, carried out in April, found women over 50 were worst hit, with 38% putting aside enough for retirement, compared with 52% last year.

Scottish Widows said although the credit crunch began two years ago, it was only now that the effects were trickling through to pension savings.

Read a selection of your comments

Top Stories

More to explore

Most read

Content is not available