We've updated our Privacy and Cookies Policy

We've made some important changes to our Privacy and Cookies Policy and we want you to know what this means for you and your data.

NI loans to transfer to Nama soon

The NI finance minister has said some Northern Ireland-based loans will soon transfer into the Irish Republic's bad bank, Nama.

They will be part of a tranche of 13.5bn euros of loans going into Nama. The transfer is expected to be completed by the middle of July.

Nama has been set up to buy and manage mainly bad property loans held by Dublin-based financial institutions.

About 5bn euros of assets going into Nama are located in Northern Ireland.

In a written answer to an assembly question from the DUP's Jim Shannon, Sammy Wilson said his department had been working to "clarify any uncertainties and issues in advance of local loans transferring into Nama".

"I, and my officials, have been working closely with the local business sector, HM Revenue and Customs and the Department of Finance in Dublin," he added.

The aim of Nama is to remove bad or impaired assets from the banks' balance sheets, allowing them to rebuild their financial strength.

Ultimately that will allow them to start lending again and get credit flowing to businesses and home buyers.

It is also hoped that it will protect or enhance the Irish Republic's international credit rating.

Developers who hold Nama loans will have 30 days to produce a credible business plan for repaying the loans.

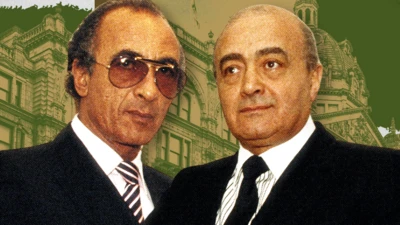

Nama has said that it will not normally reveal the identities of the developers it dealing with, however the Dublin media has named many of the companies who have had loans transferred.

Top Stories

More to explore

Most read

Content is not available